The biggest innovation opportunities exist between the echo chambers. But getting others to let you into theirs can be pretty tough. Several times I’ve tried to get papers into economics conferences and journals. I’ve only ever succeeded once. And even then, when I made it to the conference to present, it quickly became apparent that I wasn’t welcome. The main reason for my repeated rejection is that I don’t meet the mathematics quotient. There aren’t enough equations in my papers. Usually there aren’t any.

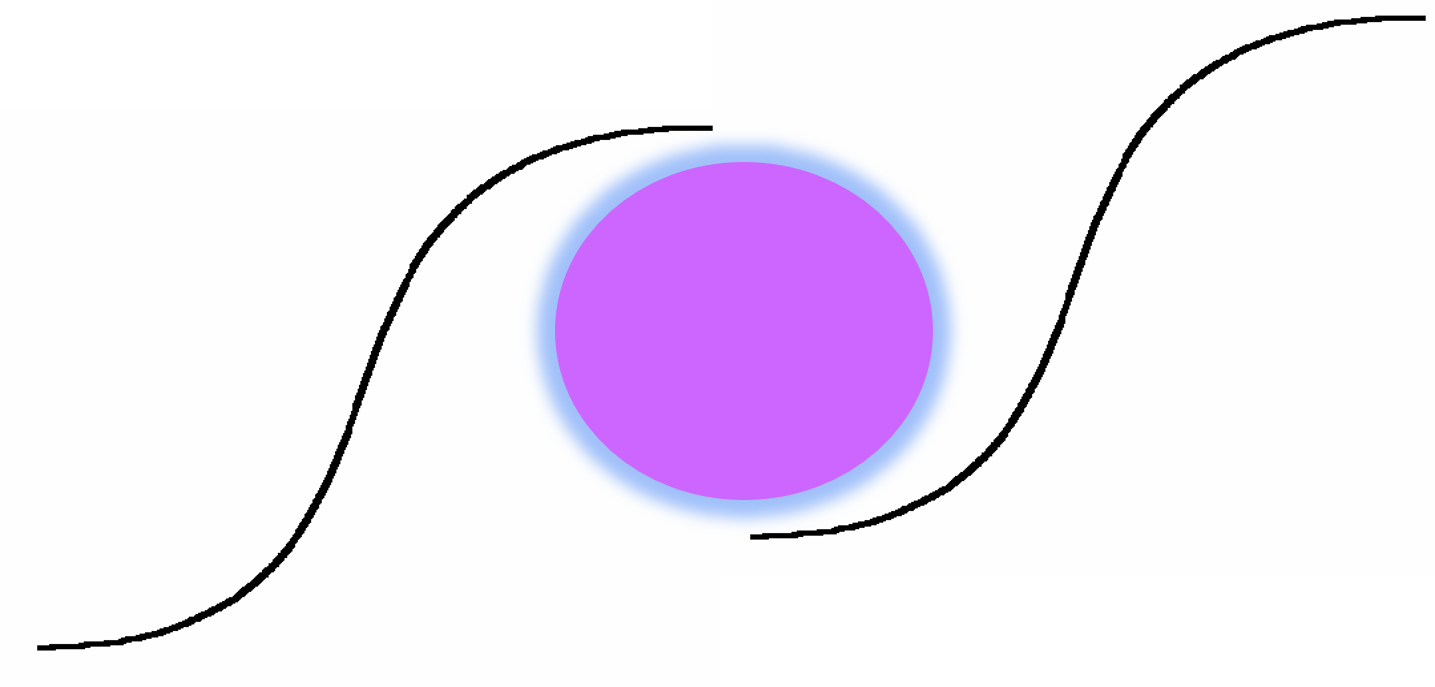

And that was kind of the point. There is no such thing as a mathematical formula to describe what is going on here:

This kind of statement seems to be another good way to inflame economists. Of course there is, I’ve had them say to me. And, speaking as someone who started his career as a mathematician, I can see where they’re coming from. It’s a pair of tangent curves laid on their side, right?

But, of course, that’s not the point. The point is the space between the two S-curves not the curves themselves. The space between the curves is where innovation happens. It’s where the current rules (‘formulae’) get challenged and replaced with new ones.

Economics is about top-down modelling of measurable patterns.

The real world emerges from innovators who’s job is to look at the world bottom-up, to look for gaps between the patterns and how to break the existing patterns.

Innovators know something that economists clearly still don’t. There is no such thing as ‘top-down’ anything in a complex world. If you’re not looking at things bottom-up, you’re getting it wrong. The only uncertainty is how quickly you’ll go wrong. Even the best economic ‘superforecaster’ can expect to have an predictable event horizon measurable in weeks. The more complex and inter-connected the world gets, the shorter this predictable period becomes. For most people, we’re lucky if our predictions of what’s for dinner tonight come good.

Economics is about correlation.

Innovation is about finding needles in haystacks. Needles being causal relationships. Which, again, you only get to find if you’re looking for what’s happening between the patterns.

Economics is about numbers.

Innovation is about putting the numbers to one side and looking for the unquantifiable.

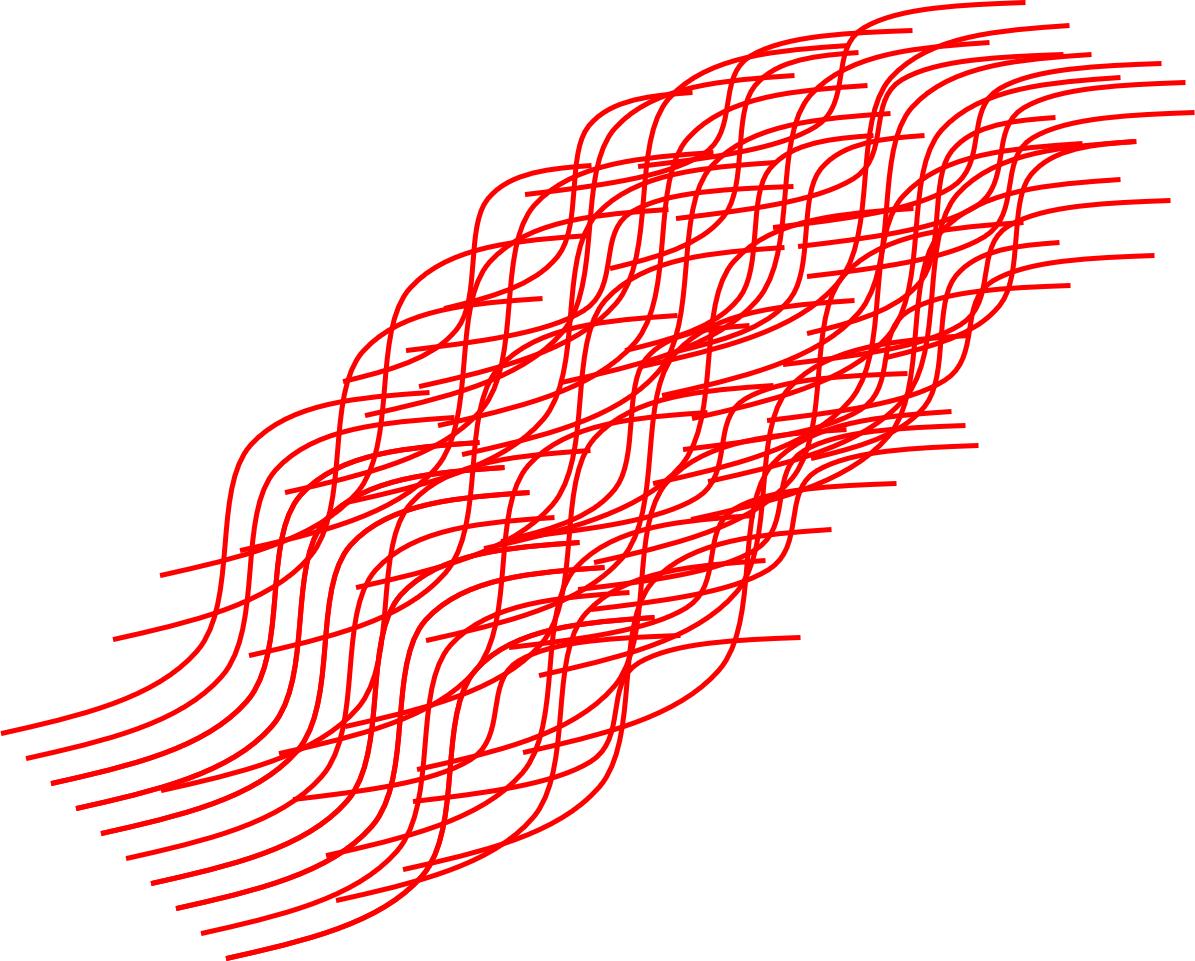

In a world which is all turbulence, when economists try and run things using spreadsheets and ticker-tape they take us all closer and closer to the edge of yet another financial precipice.

In a world which is all turbulence, the innovators are the ones that survive. They do it by having a clear compass, and looking for the weak signals that help propel things in the right direction. They look for vectors. Manage the vectors, innovators know, and the right numbers will arrive of their own accord.

I think the economist echo chamber is only going to listen to this idea after they collapse the global system again. And even then, I’m not certain. They certainly didn’t learn anything after 2008. Or, worse, they learned to look harder at the numbers, to make more numbers. In so doing, they didn’t just ‘kick the can down the road’, they gave the can wheels.

Economics by numbers is taking us ever faster to the brink of chaos and oblivion. After which all we’ll be left with are cockroaches and innovators. Only half of which sounds good to me.

The 1992 Nobel Prize in Economics – “Gary Becker has applied the principle of rational, optimizing behavior to areas where researchers formerly assumed that behavior is habitual and often downright irrational. Becker has borrowed an aphorism from Bernard Shaw to describe his methodological philosophy: “Economy is the art of making the most of life”.”

How could both the old and the new view be so bad. If Economics was actually a science, you think there would be some agreement. They are still struggling to establish their base of knowledge and how to use and apply it.